SERVICES

E&P ANALYSIS

PROJECT AND BUSINESS MANAGEMENT

RESOURCES AND RESERVES ANALYSIS

E&P ANALYSIS

CONVENTIONAL AND NON-CONVENTIONAL (TIGHT OIL, SHALE OIL AND GAS)

QUALITY CONTROL

Evaluation and quality control of seismic data, previous interpretations, and wells. Review of the appropriate format for interpretation.

Conditioning of the received information. This may include the elimination of duplicate or inconsistent data, the correction of errors, and the conversion of data to formats compatible with the software used in the interpretation.

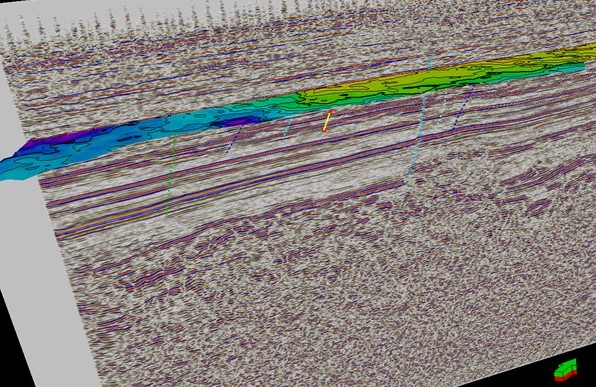

SEISMIC INTERPRETATION | GEOPHYSICS

Seismic-geological calibration. Analysis and interpretation of seismic data, mapping of horizons and fault systems. Depth conversion.

Seismic stratigraphy analysis. Interpretation of depositional systems and structures. Mapping of sequence boundaries. Analysis of internal reflection geometries, definition of seismic facies, and creation of time-thickness maps.

Generation and analysis of seismic attributes. Spectral decomposition. Trace inversion (interpretation of Acoustic and Simultaneous Impedance).

Seismic integration for predictive static reservoir modeling. Analysis of well logs vs. seismic data.

Recommendations on potential seismic processing.

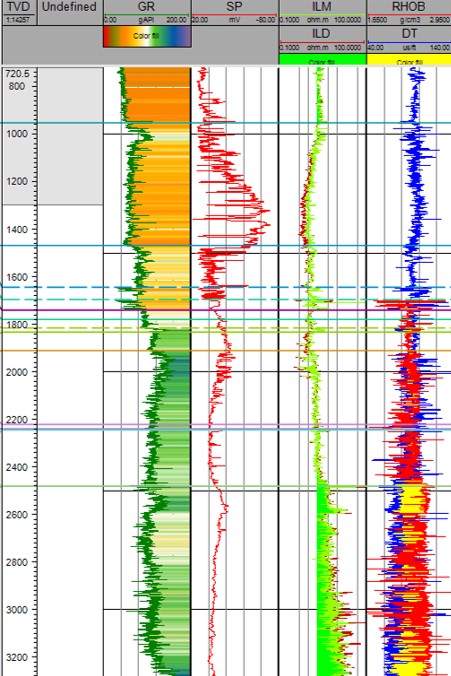

FORMATION EVALUATION | PETROPHYSICS

Reservoir characterization from cutting, sidewall core, and core data, along with sedimentological, petrographic, and petrophysical reports.

Analysis of reservoir profiles with primary porosity, fractured, tight, and shale reservoirs. Facies characterization at the rock level, and OOIP and reserve calculations at the well level. Analysis and interpretation of wellbore images.

Development of petrophysical models, property distribution such as porosity, permeability, water saturation, and improved visualization of reservoir attributes. Petrophysical support for reserve calculation exercises.

Well logging planning and sampling.

Proposal for well stimulation.

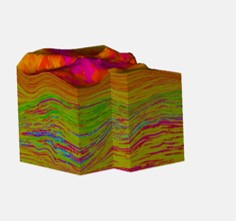

3D MODELING - ADVANCED GEOSTATISTICS

Reservoir correlation, structural and stratigraphic analysis.

Mapping and delineation of reservoir properties, integration of rock and log data.

Geostatistical data analysis.

Integrated geocellular models for exploration and development projects.

Volumetric calculation of reserves and resources.

RESERVOIR ENGINEERING

Reservoir monitoring, analysis, and optimization. Analytical and dynamic reservoir modeling, production forecasting, and economic analysis.

Drainage mechanisms and material balance. Well testing. Understanding of flow in porous media and fluid displacement. Rock and fluid properties.

Primary and secondary recovery. Management of mature fields: monitoring and optimization of secondary recovery projects.

PROJECT AND BUSINESS MANAGEMENT

IDENTIFYING OPPORTUNITIES

Identification of investment opportunities (e.g., well workovers and drilling).

Reserve certification evaluation and reporting.

Optimization of waterflood projects.

.ASSET MANAGEMENT (COLLABORATION AND TECHNICAL CONSULTING)

Evaluation of fields with existing facilities (mature and new fields) to identify low-cost production opportunities (repairs, re-completions, and reactivation of "old" wells) and new opportunities from these facilities.

Evaluation of geological, production, and economic results of well activities to optimize strategies and continuously improve timelines, designs, and data acquisition efficiency.

Planning and monitoring of development, appraisal, and exploratory well execution.

ECONOMIC PLANNING

Asset Benchmark Plan: This refers to a foundational plan that serves as a reference point for evaluating the performance and potential of assets.

Corporate Planning: This encompasses the overall strategic planning for the company, including the review of multiple field operational scenarios and the selection of the most optimal approach.

Entry to Business: This involves assessments, data handling, and expert advice for the acquisition of oil and gas properties, as well as participation in exchanges and mergers.

Portfolio Management: This focuses on managing the company's portfolio of assets, including the classification of the suitability of both assets and companies.

Opportunity Screening: This is a rapid yet detailed study option to support significant investments in field development, field rehabilitation, or enhanced recovery operations. The goal is to understand reservoir performance and evaluate future economic scenarios.

Post-Implementation Assessment: This involves post-investment analysis for asset and project optimization. It includes a thorough evaluation of investments and projects, along with performance analysis and asset optimization.

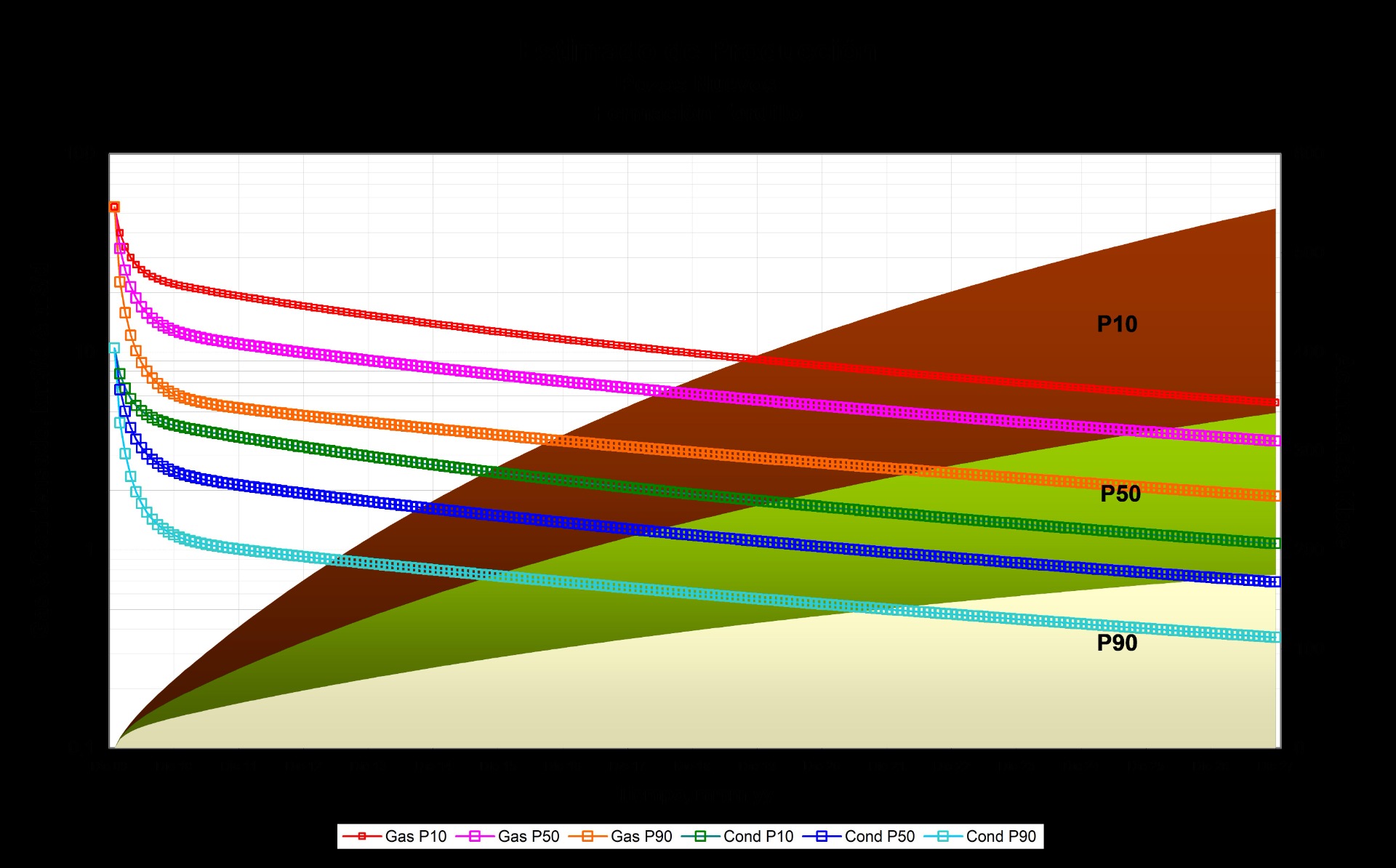

.RESOURCES AND RESERVES ANALYSIS

Prospective Resources: Assessment of geological probability of success.

Contingent Resources: Assessment of technical, economic, and regulatory barriers.

Reserves Estimation and Categorization: Calculation of commercially recoverable oil and gas volumes according to international standards (SPE-PRMS, SEC).

Regulatory Reporting: Preparation of reports for reserves certification.

Development Planning and Optimization: Maturation and implementation of studies/projects for reserves recategorization and replacement.

Importance of Resource and Reserves Analysis:

- Decision Making: Enables prioritization of exploration and development projects.

- Investment Attraction: Provides reliable information for investors.

- Regulatory Compliance: Ensures that calculations and reports meet international standards.

REQUEST OUR SERVICES

Please enter your details and we will respond as soon as possible.